Payroll Report Templates

Our experts have created Microsoft Excel compatible payroll report templates to help you compile your labor distribution and payroll register reports. You can modify them to align with your needs.

40% of small to mid-sized businesses incur IRS penalties related to incorrect payroll filings with an average penalty of $845.

TriNet Payroll software helps to simplify the payroll process, increase accuracy, and helps to ensure payroll compliance in all 50 U.S. states. And now, we offer payroll reporting, too, right in our product.

Download our Payroll Report Templates to get started with payroll reports.

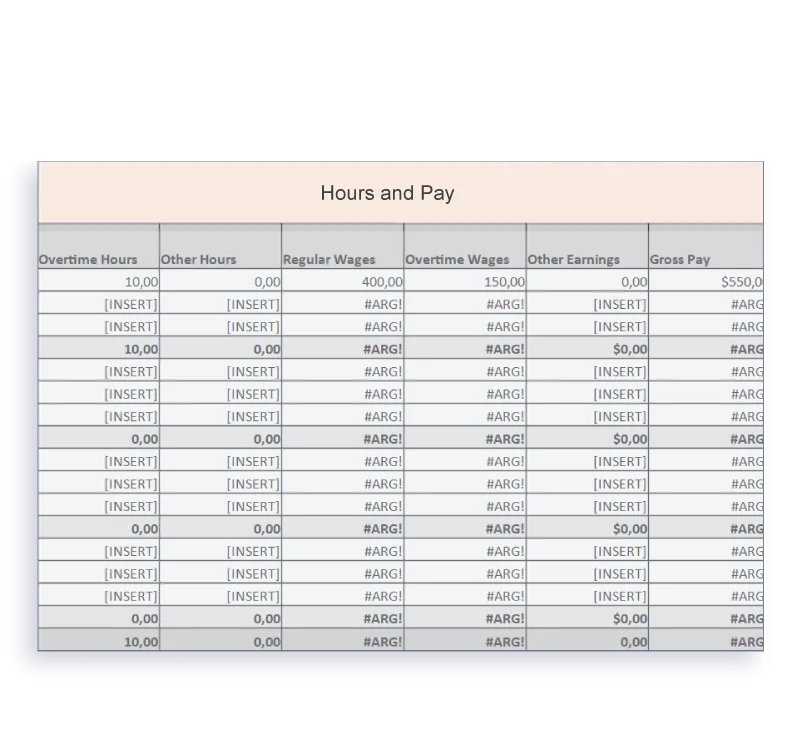

These ready-to-use excel spreadsheets include:

- Regular, overtime & other hours

- Regular, overtime & other earnings

- Reimbursements

- Deductions

- Employer contributions

- Employee & employer taxes

- Net pay by an individual employee for a payroll run or period

Save these templates, and make payroll reporting easier anytime.